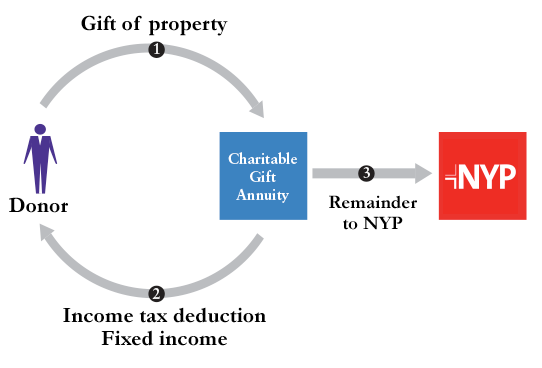

A charitable gift annuity (CGA) is a simple agreement between you and NewYork-Presbyterian in which the Hospital agrees to pay you a fixed annual income for life in exchange for your donation.

The Type of Income You Receive

A NewYork-Presbyterian CGA pays you and/or another beneficiary a fixed annual income for life. Part of your income may be tax-free, increasing the overall return to you, or taxed at the more favorable capital gains rate.

When you make an immediate payment, your income payments begin right away. With a deferred CGA, your income payments begin at a future date that you specify.

Your annuity income payments are backed by the assets of NewYork-Presbyterian.

How It Works

You make an irrevocable gift of cash or securities to NewYork-Presbyterian.

NYP pays a fixed amount each year to you and/or another person, usually a spouse, for life. Typically, a portion of these payments is tax-free.

When the CGA ends, its remaining principal passes to NYP.

Current CGA Rates

Here is a sample of the current rates as of July 2025 for single-life CGA:

| Age | Current CGA Annuity Rate |

|---|---|

| 65 | 5.7% |

| 70 | 6.3% |

| 75 | 7.0% |

| 80 | 8.1% |

| 85 | 9.1% |

| 90+ | 10.1% |

How You Can Save on Taxes

When you establish an annuity, you are entitled to an immediate federal income tax deduction for a portion of your gift if you itemize. Your deduction is based on the size of your contribution, the annuity payment rate, and the age(s) of your income beneficiary(ies). With a deferred arrangement, you receive a higher immediate income tax deduction.

With a gift of appreciated property, you can amortize payments of long-term capital gains taxes. You can also realize significant estate tax savings.

How You Can Establish a CGA

A CGA is established with an irrevocable gift of cash or marketable securities. The minimum contribution required is $10,000, and income beneficiaries for both immediate and deferred annuities must be at least 65 years old when payments begin. Your annuity is administered by BNY Wealth at no cost to you.

A New Way to Support NYP: Create a CGA Using IRA Assets

If you are 70 1/2 or older, you can now create a CGA with a gift from your IRA. When you make a one-time election donating up to $55,000 to the Hospital in a single year, you will receive regular annual payments for life.

Note: As you consider any charitable gift plan, please consult with your tax or financial advisor to determine the tax/financial implications for you and your family. NewYork-Presbyterian does not provide legal or tax advice. This communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of avoiding tax-related penalties.