A charitable lead trust (CLT) is set up by you and pays income to NewYork-Presbyterian for a number of years. At the end of the trust term the principal is either returned to you or is paid to a non-charitable entity or to a person. A CLT may provide you with substantial tax benefits, while supporting the vital work of NewYork-Presbyterian.

Two different types of CLTs provide distinct benefits:

- A CLT may allow you to make a transfer of assets to your heirs at a substantially reduced gift and estate tax cost, or

- It may provide you with substantial income tax benefits in a year when you have experienced a windfall, one-time increase in taxable income, such as a taxable payout or the sale of a business.

Either type of CLT provides an income stream to NewYork-Presbyterian for a set period of time that you choose. At the end of the trust term, the trust principal is either passed to your heirs or to a trust for their benefit, or is returned to you and may provide you with a substantial income-tax deduction in the year of the windfall.

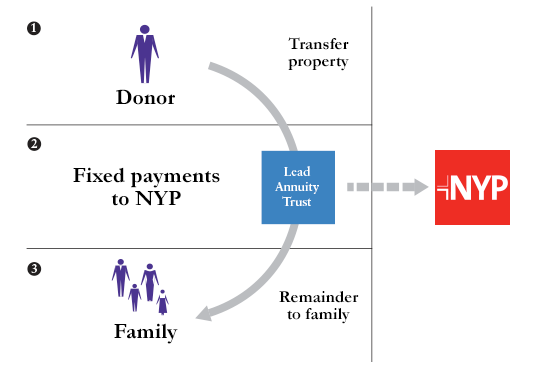

How You Can Establish a Charitable Lead Trust

- You transfer cash, securities, or other property to a trust.

- During its term, the trust pays a fixed amount each year to NYP.

- When the trust ends, its remaining principal passes to you, or to your family or other heirs you name. Trust growth distributed to your heirs may pass to them tax-free.

You can establish a charitable lead trust with publicly traded securities, closely held stock, income-producing real estate, partnership interests or a combination of the above. You may receive the most favorable capital gains tax treatment if you fund the trust with cash or non-highly appreciated assets. Typically, a lead trust is most effective if you fund the trust with assets valued at $1,000,000 or more.

Note: As you consider any charitable gift plan, please consult with your tax or financial advisor to determine the tax/financial implications for you and your family. NewYork-Presbyterian does not provide legal or tax advice. This communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of avoiding tax-related penalties.